Commodity supercycle on the cards for Australia

Many of the prices of commodities across agriculture, metals and energy are rising to multi-year highs on the back of supercharged pandemic-driven demand and reduced production.

Talk of COVID kick starting a commodities supercycle is hot and heavy, particularly in categories where the chase for food security has facilitated genuine structural demand shift.

A supercycle, where commodities trade above their long-term price trend for a decade or more, has big implications for the business of farming.

Experienced agricultural consultant Robert Hermann, Mecardo, says concepts like supercycles are big ticket items producers need to understand in order to best position their own operations, and agriculture industries as a whole, for future prosperity.

The decisions being made on-farm right now will be critical to the ability to fully capitalise on emerging potential presented by longer-term bullish commodities markets, he says.

Skyward bound

Prices in some categories, across all commodities, have shot to stratospheric levels this year as demand has grossly outstripped supply.

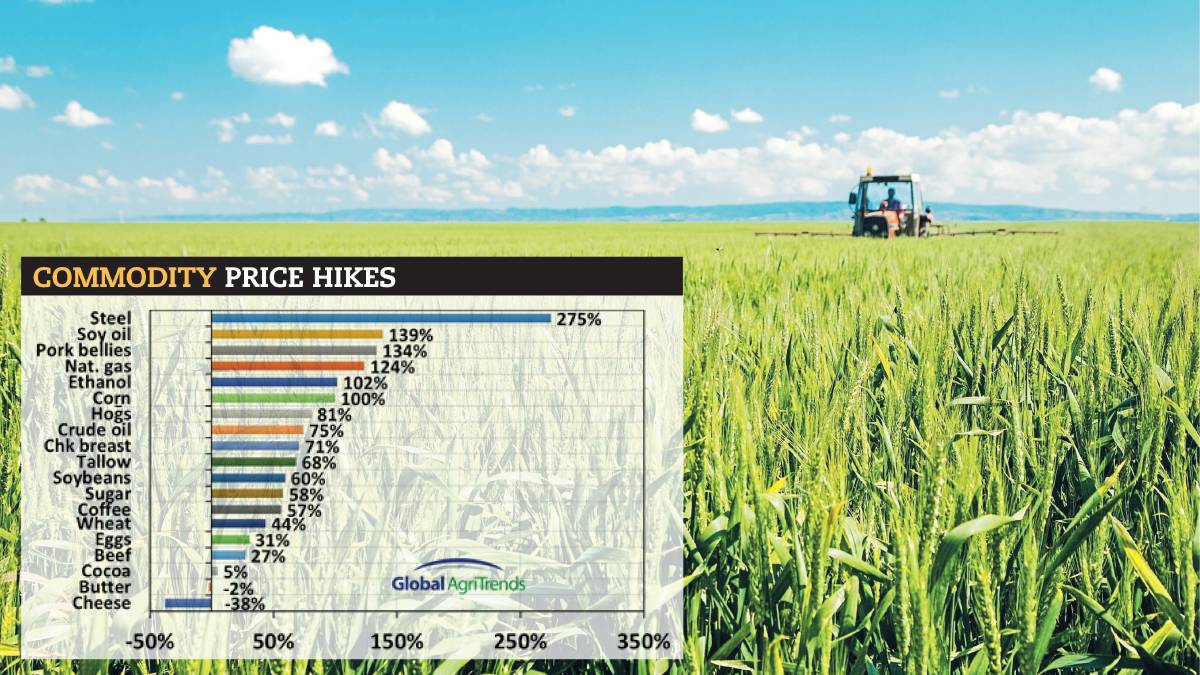

On the world stage, steel is trading at a level 275 per cent above what it was a year ago, data collated by Global Agritrends shows.

Gas, crude oil, copper, tin and iron ore are following suit.

According to the World Bank, nearly all commodity prices are now above pre-pandemic levels.

Global agriculture prices are travelling 20pc higher than a year ago and have typically reached levels not seen since the start of last decade, international economists are reporting.

In agriculture, corn, soy, pigs and chicken have led the global price charge.

In Australia, it has been cattle. The Eastern Young Cattle Indicator has continually broken new records over the past year.

To put it in perspective, in 2002 it was 242 cents a kilogram carcase weight and in the past year it has lifted by that entire amount to crash over the 1000c mark. It set a new inflation-adjusted record, which means it’s the highest it has been in real terms since the late 1960s.

Other Australian livestock indicators – for all categories of cattle, for lambs, goats and wool – have also lifted significantly, and forecasts are for all to continue on that rising plane.

In some cases, predominantly in grains, production will catch up quickly and it will be but a short-lived bullish market, analysts say.

But for many, a ‘new normal’ is being touted and in true commodity supercycle fashion, the rising tide is lifting all boats. Booming prices in one commodity are feeding the ability for players to fork out big money for others.